As Benjamin Franklin once said, "By failing to prepare, you are preparing to fail." In today’s volatile business environment, organizations face risks that can threaten their operations and success. To stay ahead, leadership must take a fail-safe approach to risk management—this is where enterprise risk management (ERM) comes in.

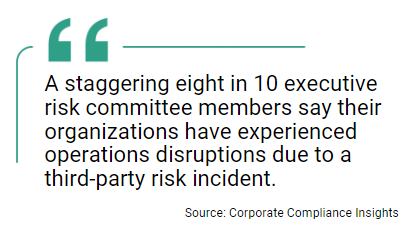

Enterprise risk management is a comprehensive, top-down framework designed to identify and mitigate risks before they materialize. While most businesses have ERM systems, the real question is - Are they truly effective? The answer lies in enhancing ERM with AI-powered predictive intelligence.

Predictive intelligence helps organizations anticipate and address risks early, transforming risk management from reactive to proactive approach. This article will cover the basics of enterprise risk management, outline effective strategies for implementation, and explore key trends. We’ll also show how merging predictive intelligence with Enterprise risk management equips companies to handle threats more efficiently, ensuring resilience and future-proofing.

What is Enterprise Risk Management (ERM), and Why is it Important?

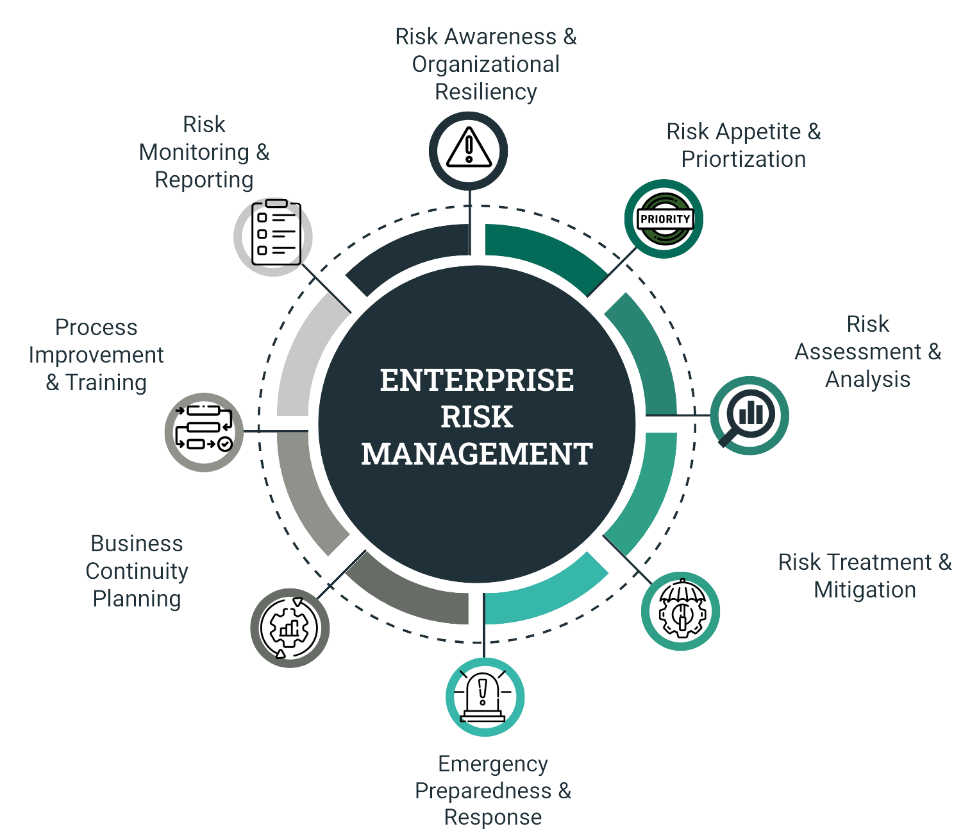

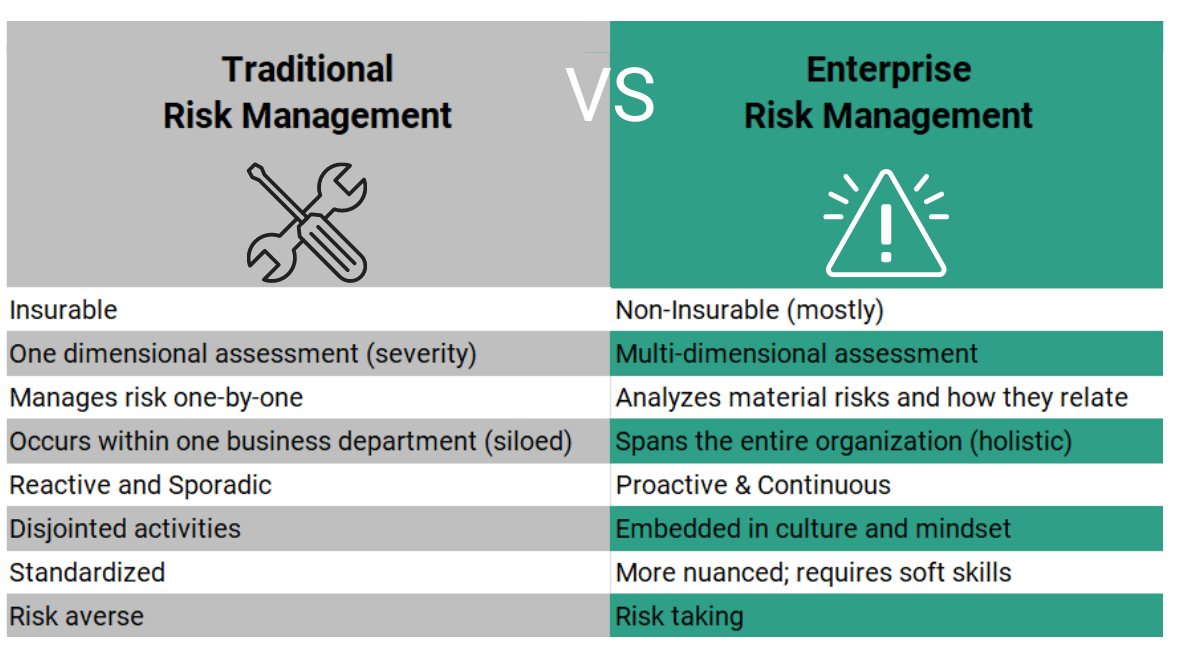

At its core, enterprise risk management (ERM) is a structured, organization-wide approach to identifying, assessing, and mitigating risks. Unlike traditional risk management, which often operates in silos and focuses on individual departments or projects, ERM offers a holistic view of the entire organizational risk landscape. This unified perspective allows executives to make informed decisions based on comprehensive data gathered across all functions of the business.

An effective enterprise risk management helps organizations embed risk management into their strategic planning, proactively addressing threats that could undermine business objectives. However, while enterprise risk management provides numerous advantages, many traditional models are still too static and reliant on historical data, lacking the agility to adapt to fast-changing risks.

This is where predictive intelligence becomes transformative. Organizations can dynamically anticipate risks and seize opportunities by integrating real-time analytics and machine learning with ERM. The future of enterprise risk management lies in preventing risks before they manifest.

The 5 Pillars of a Strong Enterprise Risk Management Framework

For organizations looking to establish a robust enterprise risk management system, a foundation built on five key pillars ensures sustainability and relevance:

- Governance and Culture - Leadership must foster a risk-aware culture with governance structures that promote accountability.

- Strategy and Objective-Setting - Risk management should directly align with the organization’s strategic goals, ensuring that risks are identified within the context of corporate objectives.

- Risk Identification - Recognizing both internal and external risks is crucial for proactive management.

- Risk Response - Develop tailored strategies—whether through mitigation, transfer, or acceptance- to address identified risks.

- Ongoing Monitoring - As risks evolve, continuous monitoring and adaptive strategies are vital to staying ahead of new challenges.

These pillars guide organizations in creating an agile enterprise risk management system that supports long-term success.

The Shortcomings of Traditional Enterprise Risk Management Models

Traditional ERM frameworks, though effective in structured environments, struggle in fast-paced, uncertain business climates. They often rely heavily on historical data, which limits their ability to foresee emerging risks that don’t fit within known patterns. Static assessments and periodic reviews, while useful, aren’t enough to keep pace with today’s rapidly shifting market dynamics, geopolitical uncertainties, and technological disruptions.

Key limitations of traditional ERM include:

- Lack of Real-Time Insights - Without dynamic, real-time data analysis, risks may go unnoticed until it’s too late.

- Slow Response to Emerging Threats - The reliance on historical trends hampers an organization's ability to respond quickly to novel risks.

- Inability to Leverage Predictive Insights—Most ERM systems aren’t equipped with advanced data analytics tools to predict future risks accurately.

Given these constraints, it’s clear that businesses need a more future-focused approach to risk management.

The Power of Predictive Intelligence in Enterprise Risk Management

Predictive intelligence leverages AI, machine learning, and advanced analytics to forecast risks, trends, and opportunities. When applied within an ERM framework, it elevates risk management by delivering actionable insights that enable organizations to proactively address potential risks, rather than responding after the fact.

Key Benefits of Integrating Predictive Intelligence in ERM:

- Early Risk Detection - Predictive intelligence models uncover accurate hidden patterns, allowing for proactive risk mitigation.

- Enhanced Scenario Planning - Predictive models simulate various risk scenarios, enabling organizations to evaluate the potential impact of different risks and develop more effective mitigation strategies.

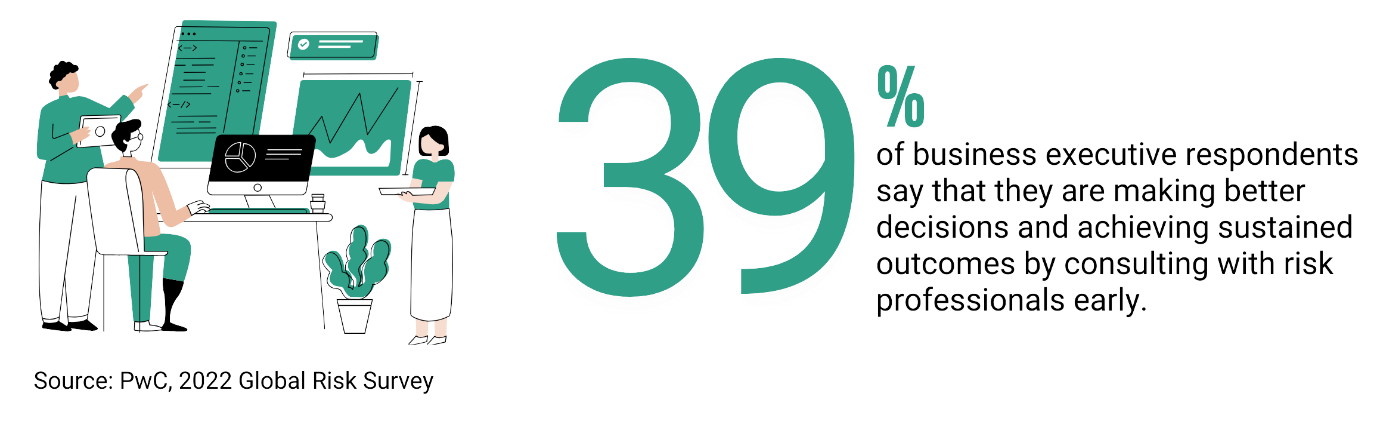

- Informed Decision-Making - AI-driven insights enable business leaders to make more strategic, data-backed decisions, improving overall risk management outcomes.

- Real-Time Monitoring - Predictive intelligence tools offer continuous, real-time updates on risk factors, allowing organizations to stay agile and adjust their strategies as needed.

Integrating predictive intelligence into ERM elevates risk management into a strategic asset. By uncovering hidden opportunities and enabling data-driven decisions, organizations can transform uncertainty into a competitive advantage, positioning risk as a catalyst for growth and innovation.

Five Steps to Building a Predictive Enterprise Risk Management

Organizations need to evolve their ERM framework into a dynamic, real-time system to unlock the power of predictive intelligence fully. Here’s how to begin that transformation:

- Establish a Unified Risk Perspective—It is essential to have a unified understanding of risk across the organization. Develop standardized methodologies for risk assessment to ensure consistency in identifying and addressing risks.

- Leverage AI-Driven Data Insights - Data is the cornerstone of predictive intelligence. By collecting and analyzing data from internal and external sources, organizations can better understand emerging risks and trends. AI models can then be used to analyze this data, predicting future risks and offering actionable insights.

- Prioritize Risks Based on Predictive Analytics—Organizations can prioritize risks more effectively with predictive intelligence. Focus resources on the most pressing risks, those that are most likely to impact the business.

- Integrate Real-Time Risk Monitoring - Continuous monitoring of the risk landscape is vital. Predictive intelligence tools provide real-time data updates, enabling organizations to stay on top of emerging risks and adjust their strategies accordingly.

- Foster a Risk-Aware Culture - While technology is key to implementing predictive ERM, a risk-aware culture is equally important. Employees across the organization need to understand the importance of risk management and actively participate in identifying and reporting potential risks.

By following these steps, organizations can create a predictive enterprise risk management framework that is robust, proactive, and adaptable.

Enterprise Risk Management - Real-World Use Cases

While the theoretical advantages of predictive intelligence in ERM are compelling, it’s important to consider its real-world applications. Various industries are already reaping the benefits of AI-driven risk management. Here are a few examples:

- Financial Services - Banks and financial institutions face constant regulatory pressure and market volatility. Predictive intelligence helps them analyze historical data and market trends to predict financial risks and preempt regulatory violations.

- Supply Chain Management - Predictive analytics enables companies to foresee disruptions in their supply chain, whether due to natural disasters or shifts in supplier reliability. By identifying these risks early, businesses can adjust their supply chain strategies, minimizing potential disruptions and maintaining operational continuity.

- Healthcare - In the healthcare sector, predictive intelligence forecasts potential operational risks such as equipment failure, compliance issues, or even staffing shortages. This allows hospitals to allocate resources more efficiently and maintain high levels of patient care without unnecessary disruptions.

In all these cases, the combination of predictive intelligence and enterprise risk management allows organizations to manage risks and uncover new opportunities for growth and innovation.

Conclusion

In conclusion, a robust enterprise risk management (ERM) framework is essential in today's rapidly evolving business environment. ERM provides a systematic approach to risk management, ensuring consistency and a comprehensive understanding of potential risks, ultimately safeguarding revenue. Moreover, it facilitates strategic decision-making, promotes accountability, and fosters a culture of compliance. To effectively manage the wide range of organizational risks, it is crucial to integrate ERM with strategic approaches and modern business solutions rather than addressing risks in isolation.

Incorporating AI-powered predictive intelligence into ERM significantly enhances its effectiveness by transforming risk management from reactive to proactive. TrueProject, a KPI-driven predictive intelligence SaaS solution, strengthens the ERM framework by offering real-time risk detection, AI-driven scenario analysis, and comprehensive project visibility. This integration enables organizations to respond to threats swiftly, make data-backed decisions in uncertain conditions, and optimize risk management processes.

Embedding advanced technology solutions into the ERM structure, TrueProject enables businesses to anticipate risks before they materialize, ensuring agility and resilience. With real-time insight into project health, organizations can stay ahead of emerging risks, achieve successful project outcomes, and align their efforts with their strategic objectives.

More information about TrueProject on trueprojectinsight.com

About the Author:

Nisha Antony is an accomplished senior marketing communications specialist at TrueProject and a leader in predictive intelligence. With over 16 years of experience, she has worked as a Senior Analyst at Xchanging, a UK consulting firm, and as an Internal Communications Manager on a major cloud project at TE Connectivity.

She is an insightful storyteller who creates engaging content on AI, machine learning, analytics, governance, project management, cloud platforms, workforce optimization, and leadership.

Endnotes:

- Kayne McGladrey. “The Ultimate Guide to Enterprise Risk Management.” Hyperproof: May 9, 2023. https://hyperproof.io/resource/the-ultimate-guide-to-enterprise-risk-management/

- George Lawton. “12 top enterprise risk management trends in 2023.” TechTarget: March 03, 2023. https://www.techtarget.com/searchcio/feature/8-top-enterprise-risk-management-trends

- Shauvik Roy. “What Is Enterprise Risk Management? A Comprehensive Guide.” SelectHub: (n.d.) https://www.selecthub.com/risk-management/enterprise-risk-management/

- Research and Markets Content Team. “Enterprise Risk Management Global Market Report 2023.” Research and Markets: March 2023. https://www.researchandmarkets.com/report/enterprise-risk-management

- Staff and Wire Reports. “Gartner ERM Miss.” Corporate Compliance Insights: February 21, 2023. https://www.corporatecomplianceinsights.com/gartner-erm-miss/

- Carnegie Mellon University Team. “Enterprise Risk Management.” Carnegie Mellon University: (n.d.) https://www.cmu.edu/erm/

- Strategic Decision Solutions Team. “8 Ways Enterprise Risk Management is Different (…and Better) than Traditional Risk Management.” Strategic Decision Solutions: September 04, 2019. https://strategicdecisionsolutions.com/traditional-risk-management-erm-differences/