Quick Summary: A 2023 McKinsey study found that large projects typically overrun budgets by 27% and schedules by 22%, wiping out margins and strategic advantage. Earned Value Management (EVM) answers this by uniting scope, schedule, and cost in a single objective framework to detect variances early and steer with confidence. Yet classical EVM is retrospective—it shows where you are, not where you’re going. Predictive intelligence provides the missing foresight, turning earned value into forward value. Enriched with machine learning, trend analysis, and sentiment insights, leaders can surface hidden risks sooner, act faster, and keep complex programs precisely aligned with strategic goals.

Why Is Earned Value Management (EVM) More Critical Than Ever?

Projects today are bigger, faster, and riskier. Digital transformations cross continents, infrastructure builds involve global supply chains, and multi-vendor technology programs run on accelerated timetables. In this environment, a small delay or cost slip can compound into market penalties and reputational damage.

The evidence is sobering. A landmark analysis of public-sector IT programs found average schedule overruns of 24% and cost overruns of more than 18%. Similar patterns appear in construction, energy, and large-scale services. Without early warning, overruns surface only when budgets are exhausted and recovery options are limited.

Several forces make EVM indispensable today:

- Exploding complexity. Projects now operate as networks of interdependent teams and external partners. Hidden handoffs and shifting regulations multiply the risk of unnoticed drift.

- Demand for transparency. Boards and sponsors expect data-rich insights, not slide-deck assurances. Stakeholders want a credible, continuously updated narrative of value delivered.

- Lagging traditional reports. Percent-complete charts and cost-to-date metrics reveal history but fail to project the future. They rarely expose trends early enough to change outcomes.

- Mature predictive tools. AI and machine learning are now practical and affordable. They can analyze historical performance and real-time signals to reveal risk before a single index flashes red.

For any portfolio where missed milestones can mean lost revenue or regulatory exposure, EVM is no longer optional—it is core governance infrastructure.

Before redefining delivery processes, run a TrueProject SnapShot to baseline hidden risk drivers and pinpoint latent gaps. This early diagnostic makes every subsequent EVM investment more reliable.

What Is Earned Value Management and How Does It Work?

EVM is often mistaken for a set of formulas. The management discipline integrates the three most critical project dimensions—scope, cost, and time—into a single, quantifiable performance model.

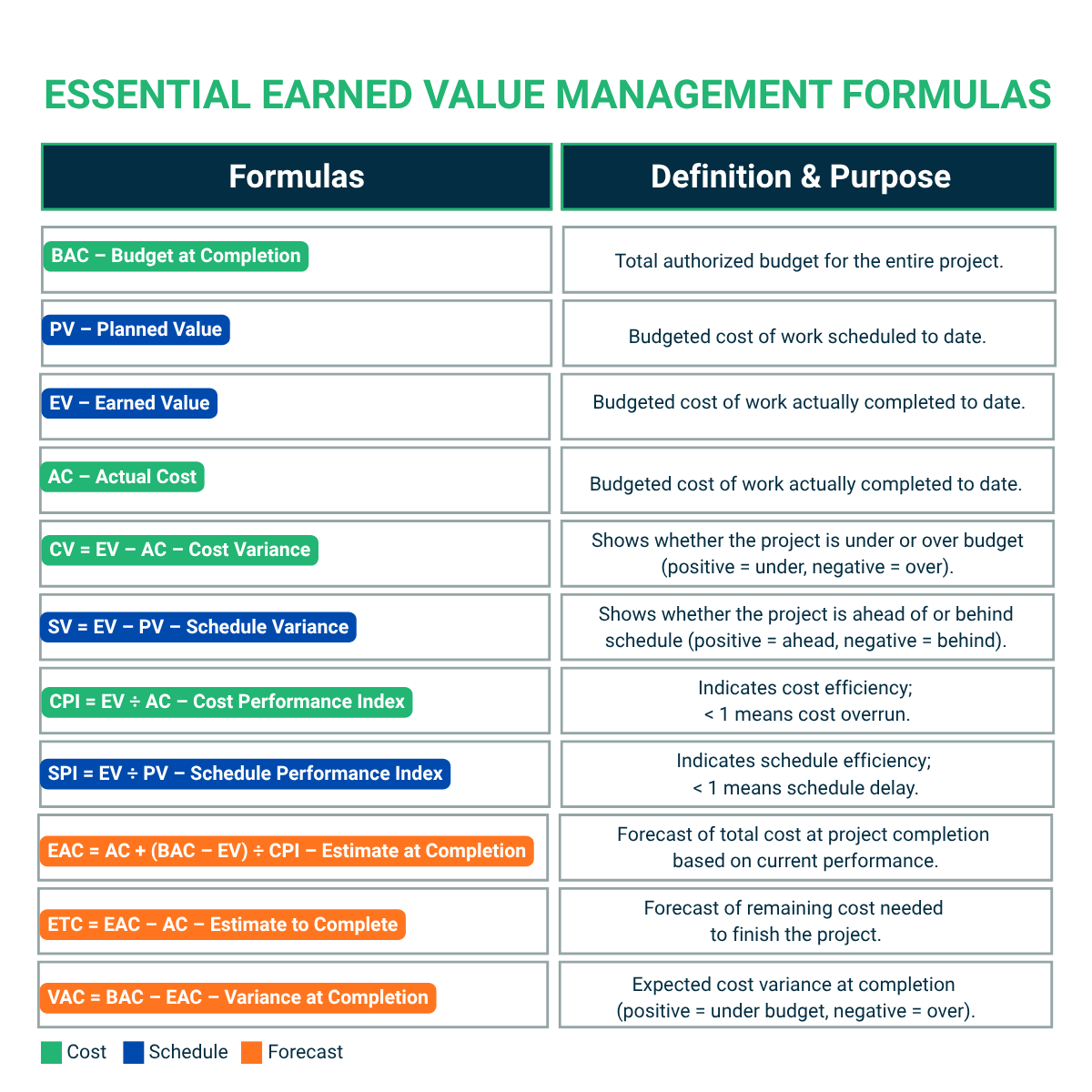

Core building blocks

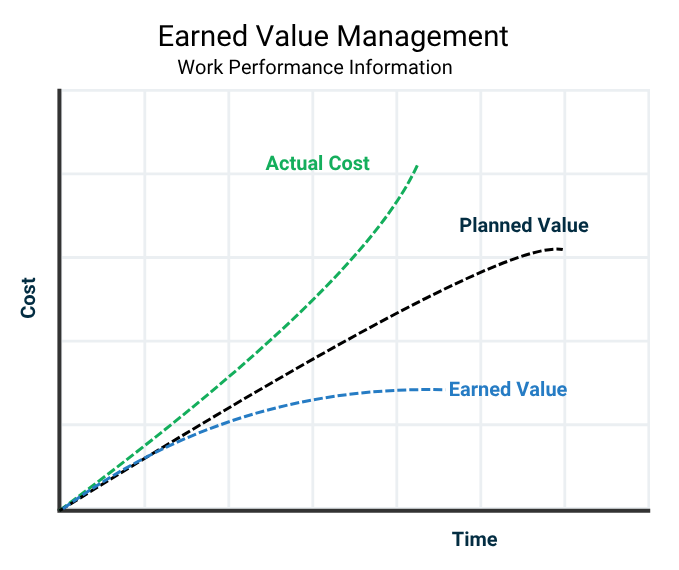

- Planned Value (PV): the budgeted cost for work planned to date—the “should-have” curve.

- Earned Value (EV): the budgeted cost of work actually performed—the true “value earned.”

- Actual Cost (AC): the actual cost incurred for the completed work.

From these elements, decision-making metrics emerge:

- Cost Variance (CV = EV – AC) and Schedule Variance (SV = EV – PV) quantify deviation.

- Cost and Schedule Performance Indices (CPI = EV/AC, SPI = EV/PV) express efficiency.

Forecasts such as Estimate at Completion (EAC) and To Complete Performance Index (TCPI) predict final outcomes and the effort needed to meet

Why rigor and context matter

The method assumes that your baseline is credible. If initial scope or schedule assumptions are weak, EVM will faithfully—but uselessly—reflect those flaws. Likewise, a high SPI can mislead if the critical path lags or milestones are front-loaded.

EVM also demands consistent measurement rules—for example, milestone credit or 0/100 progress—so earned value is calculated uniformly across teams. Without discipline, numbers become noise.

While EVM began in defense and heavy engineering, today it drives results across IT programs, product launches, and service portfolios. Modern adaptations—such as sprint-level baselining—allow agile teams to combine flexibility with financial visibility.

Most importantly, EVM is not a reporting formality; it is decision infrastructure. The true value lies in the variance story: why a control account is slipping, what corrective action is realistic, and how far downstream the impact will travel.

How Do You Build a High-Performing Earned Value Management (EVM) Capability?

Implementing EVM is not a plug-and-play activity; it is an organizational transformation that reshapes how projects are planned, measured, and governed.

What Is the First Step in Implementing EVM?

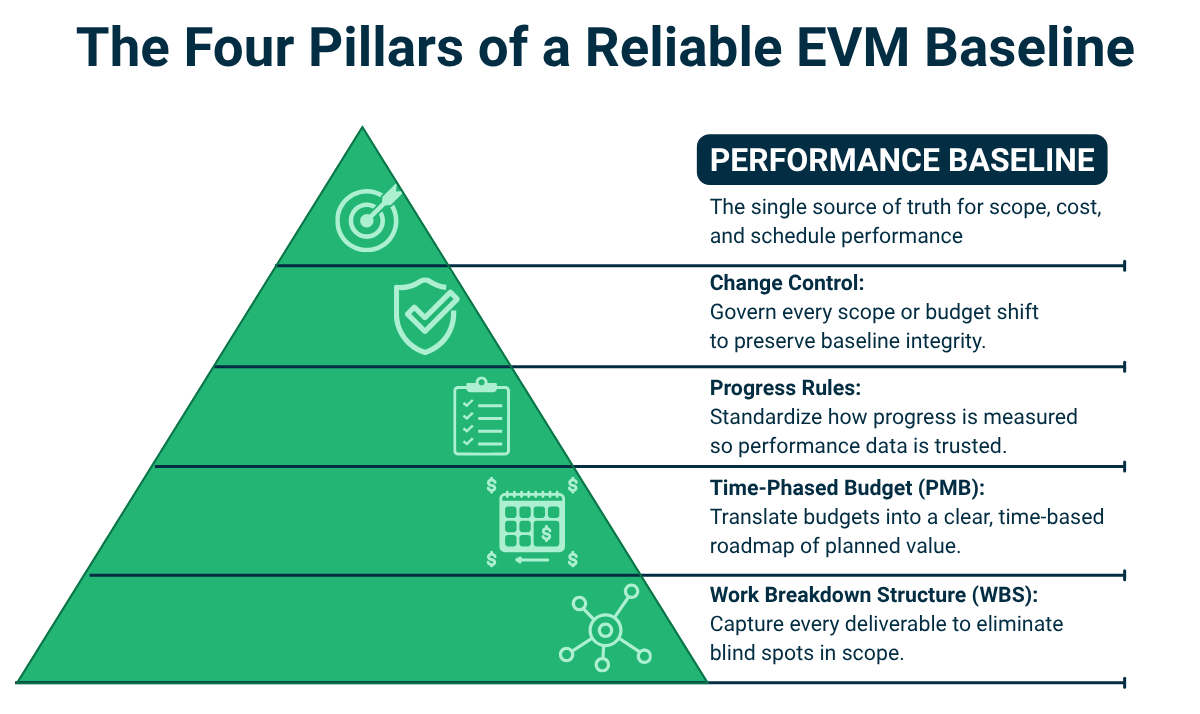

One of the most essential EVM implementation steps is building a solid, validated baseline. It starts with a detailed Work Breakdown Structure (WBS) that captures every deliverable without omission. Each work package or control account should be clearly mapped to the Organizational Breakdown Structure (OBS) to ensure transparent accountability—a cornerstone of governance best practices.

Next, convert the WBS into a time-phased Performance Measurement Baseline (PMB)—your project’s planned value curve over time. For high project baseline accuracy, the PMB must reflect realistic resource assumptions, logical task sequencing, and potential risk factors. A weak or incomplete baseline will compromise downstream metrics like CPI, SPI, and EAC.

Lastly, define and apply consistent progress-measurement rules. Whether you choose 0/100, 50/50, or milestone credit methods, consistency is non-negotiable. Without it, earned value becomes a moving target, making comparisons across teams or reporting periods unreliable.

How Do You Monitor and Steer Projects Using EVM?

During execution, actual cost (AC) data from procurement, timesheets, and ERP systems must flow seamlessly into the EVM environment. Project teams then apply the agreed measurement rules to calculate earned value (EV).

With PV, EV, and AC aligned, cost and schedule variances (CV, SV) and performance indices (CPI, SPI) can be computed continuously. But insight demands more than numbers. Leadership must interrogate the story:

- Which work packages are trending negative?

- What systemic causes—supplier delays, design bottlenecks, resource conflicts—are emerging?

- How sensitive is the overall forecast to one control account’s performance?

Use these insights to adjust plans, shift resources, or re-sequence tasks before minor variances become structural failures.

How Does Governance Drive EVM Success?

Effective EVM hinges on governance discipline. Establish variance thresholds (for example ±5% cost or ±10% schedule) that trigger automatic escalation and corrective action. Pair concise dashboards and trend lines with narrative commentary so executives see the numbers and their implications.

This is also the ideal point for introducing predictive intelligence. By learning from historical patterns and real-time signals, TrueProject can detect micro-variances before formal thresholds are crossed and recommend targeted mitigation.

As you design and launch your EVM capability, request a TrueProject Demo to see how real-time anomaly detection and proactive recommendations can protect budgets and timelines from day one.

What Are the Common Challenges in EVM and How Can You Overcome Them?

Even a perfectly engineered framework can falter if organizational realities are ignored.

Cultural headwinds

Teams may perceive EVM as a compliance burden or a vehicle for blame. Left unaddressed, this attitude discourages honest reporting and undermines trust in the data. Senior leaders must reframe EVM as a performance enabler—a way to secure resources early and protect delivery commitments. Piloting EVM on a flagship project and sharing tangible results (fewer late changes, faster decision cycles) helps win support.

Baseline instability

An EVM system is only as reliable as its baseline. Uncontrolled scope changes or casual re-baselining create “phantom progress” and distort every variance calculation. A disciplined change-control process—with documented impact analysis and formal approvals—preserves the integrity of the PMB and keeps historical trends meaningful.

Data timeliness and quality

Delayed or inconsistent cost feeds can make CPI and SPI little more than historical curiosities. Automating data integration across scheduling, finance, and procurement systems and enforcing firm cut-off times ensure the EVM view remains current and trusted.

Hybrid and agile environments

EVM was conceived in linear, plan-driven settings. Today, however, many organizations run agile or hybrid portfolios. The solution is adaptation, not abandonment. Rolling-wave planning and release-level control accounts allow teams to measure value incrementally while maintaining EVM’s financial and schedule discipline.

Predictive intelligence strengthens all these defenses. By scanning for subtle performance drifts or stakeholder sentiment shifts that warn leaders long before traditional metrics change.

If cultural resistance, baseline fragility, or hybrid complexity challenge your EVM journey, schedule a discussion with TrueProject to explore how predictive intelligence can hard-wire foresight and resilience into your practice.

Which Metrics Best Measure EVM Success?

The real test of EVM lies in hard metrics that indicate both present health and future trajectory.

Core indicators

- Cost Performance Index (CPI) and Schedule Performance Index (SPI): Healthy projects typically stay in the 0.95–1.05 range. Sustained readings or sharp negative trends outside that window signal structural issues.

- Estimate at Completion (EAC): Significant or accelerating variance between EAC and Budget at Completion (BAC) suggests hidden risk or faulty assumptions.

- To Complete Performance Index (TCPI): A value above 1.2 implies unrealistic efficiency required to finish on budget.

Trend behaviour matters more than static numbers. A CPI of 0.95 is benign if steady, but worrisome if it has declined for three consecutive periods.

External benchmarks

Industry research confirms the payoff. Organizations with mature EVM practices are far more likely to meet cost and schedule targets and realize expected benefits³. Comparing your CPI, SPI, and EAC trends against sector peers validates whether performance is genuinely under control.

Adding the predictive dimension

Classic EVM is still retrospective. Predictive intelligence extends its reach by learning from historical data and combining it with real-time signals such as team sentiment and external risk factors. This allows leaders to spot accelerating variances and act before formal thresholds are crossed.

To convert these success metrics from backward-looking reports into real-time strategy levers, schedule a discussion with TrueProject and explore how its predictive dashboards and early-warning analytics help sustain performance and optimize portfolio decisions.

What’s Next for EVM? The Role of Predictive Intelligence

Earned Value Management began as a way to measure cost and schedule performance. Its next chapter is to anticipate and influence outcomes in real time.

AI-driven foresight

Machine learning can mine historical EVM data to detect patterns that consistently lead to schedule or cost overruns—supplier delays, design bottlenecks, staffing imbalances. Natural language processing goes further by scanning meeting notes, emails, and chat messages for sentiment changes often preceding formal risk flags.

This means potential trouble is visible weeks earlier than traditional EVM can reveal.

Continuous forecasting

Instead of static, monthly reports, predictive engines allow continuous recalculation of CPI, SPI, and EAC. When a control account starts trending off-course, the system can automatically model what-if scenarios—e.g., “What if we accelerate this work package?” or “What if we reallocate resources to a critical path?”—so decision makers can act immediately.

Human-centered decision support

Predictive intelligence doesn’t just feed leaders more data. It filters and prioritizes information to recommend the most effective interventions based on historical success rates. Rather than asking project teams to interpret dozens of indices, the system distills insight into clear, actionable choices.

TrueProject embodies this future. Combining EVM data with operational and sentiment signals generates early-warning heat maps, forecasts schedule and budget drift, and recommends the best corrective actions—all before CPI or SPI shifts noticeably.

To see how predictive intelligence can transform EVM from a backward-looking report into a proactive decision engine, request a TrueProject Demo and experience live early-warning analytics in action.

How Does Predictive Intelligence Transform Earned Value into Forward Value?

Earned Value Management has become an imperative for executives. Uniting scope, schedule, and cost into a single objective framework allows organizations to detect variances early, confidently steer capital, and demonstrate accountability to boards and regulators. It elevates project reporting from an after-the-fact check to an enterprise-wide control mechanism. Yet even the most disciplined EVM only reveals what has already happened.

The decisive next step is predictive intelligence—technology that anticipates risk before indices flash red and suggests targeted actions while there is still time to act. When predictive analytics enrich EVM data, companies no longer manage variance; they outpace it, turning earned value into forward value and ensuring strategic alignment and financial integrity.

This is precisely where TrueProject sets a new standard. TrueProject is an AI-powered predictive intelligence platform built to enhance EVM from the inside out. It continuously ingests earned value data, operational metrics, and stakeholder sentiment to surface early-warning signals, forecast downstream impacts, and recommend precise corrective actions. By transforming earned value into forward value, TrueProject enables leaders to act decisively and consistently achieve superior outcomes.

Strengthen your EVM practice and future-proof your project governance—request a TrueProject Demo today to see how predictive intelligence turns EVM into a living decision system that delivers sharper foresight and stronger, more predictable results.

FAQ – Earned Value Management

Q1: What is Earned Value Management? A project control methodology that integrates cost, schedule, and scope to measure performance analytics and forecast outcomes using metrics like CPI, SPI, and EAC.

Q2: What is the first step in implementing EVM? Start with a validated baseline built from a complete WBS and consistent progress-measurement rules.

Q3: Why is EVM critical today? Because projects face tighter budgets, complex dependencies, and demanding stakeholders. EVM provides early, objective visibility so leaders can correct course before overruns escalate.

Q4: How does predictive intelligence enhance EVM? Predictive analytics mine historical and real-time data to forecast risks, detect hidden trends, and recommend proactive interventions—transforming EVM from a reporting tool into a decision engine.

Q5: Can EVM work with agile or hybrid delivery? Yes. Rolling-wave baselines or release-level control accounts let teams maintain EVM’s rigor while embracing iterative development.

Q6: What metrics best indicate EVM success? Stable CPI and SPI near 1.0, minimal EAC drift, and realistic TCPI values demonstrate balanced cost, schedule, and scope.