Project value realization (PVR) was likely the furthest thing from Puff Daddy’s mind when he coined the phrase “It’s all about the Benjamins.” However, I will argue that it is the perfect phrase for evaluating whether your technology project was successful.

Throughout my career, I have participated in hundreds of technology projects of every shape, size, and ilk. I have witnessed scope creep, scope shrink, outside the box, boxed-in, workarounds, plow throughs, one-offs, two-offs, cut-offs, right ways, wrong ways, estimates, guestimates, WAGs, waterfalls, iterations, agile, analysis paralysis, failing fast, failing slow, heroes, zeros, and all other points in between.

Yet, for every type of project, it comes down to one thing and one thing only. Did you get the value?

You might ask, what is value? Every WORTHWHILE technology project ever undertaken was done so to deliver some form of value. Whether reducing costs, creating new revenue, reducing risk, or providing speed, all worthwhile projects produce measurable value. I remember years ago having a debate with my engineering and operations organization. I asked for the return on investment to replace network switches in over 1000 retail locations. The project leader looked at me and said, “There is no return on investment. We have to do this project.” I then asked my favorite one-word question, “Why?” “Because the current switches are obsolete,” he responded. “OK, so what happens when a switch breaks?” I asked. The project leader responded, “The store can’t perform functions that need the network.” “Such as?” I asked. “Item lookups, specialty sales, receiving, cycle counts, and things like that,” was the reply. “Isn’t there value in that?” I asked. “Well, yeah, I guess so,” was the reply. I said, “So, let’s quantify the value of the services not provided when a switch breaks, and then we can determine if the value of these services offset the replacement cost.”

You might ask, what is value? Every WORTHWHILE technology project ever undertaken was done so to deliver some form of value. Whether reducing costs, creating new revenue, reducing risk, or providing speed, all worthwhile projects produce measurable value. I remember years ago having a debate with my engineering and operations organization. I asked for the return on investment to replace network switches in over 1000 retail locations. The project leader looked at me and said, “There is no return on investment. We have to do this project.” I then asked my favorite one-word question, “Why?” “Because the current switches are obsolete,” he responded. “OK, so what happens when a switch breaks?” I asked. The project leader responded, “The store can’t perform functions that need the network.” “Such as?” I asked. “Item lookups, specialty sales, receiving, cycle counts, and things like that,” was the reply. “Isn’t there value in that?” I asked. “Well, yeah, I guess so,” was the reply. I said, “So, let’s quantify the value of the services not provided when a switch breaks, and then we can determine if the value of these services offset the replacement cost.”

In the end, there was significant value derived from having an operational (and secure) network.

While it was cost deferral (something most CFOs hate), there was a demonstrable value to doing the project.

This story illustrates that even a highly technical project with little business involvement has measurable benefits (and value). Said another way, “benefits create the Benjamins.”

Benefits Create “the Benjamins”

Assuming we are all on board with the reasons we do projects is the benefits (and value), do we hold ourselves accountable for obtaining that value? In the same vein, do we know how much money we lose when projects don’t go as planned?

Accountability begins with project estimates. The primary components of an estimate include:

- Scope (what we will deliver AND the value of the benefits)

- Time (duration and hours)

- Cost

Often, organizations have a prioritization process that evaluates the costs and benefits to determine if and when a project will be started.

How good are these estimates? The answer is better than in years past but still lacking. The 2021 PMI Pulse of the Profession Report cited only 55% of projects are completed on time, 62% are within budget, and 73% met goals. I will argue the 73% meeting goals is slightly misleading. Perhaps it should read, “met goals with higher costs and longer delivery times.”

How good are these estimates? The answer is better than in years past but still lacking. The 2021 PMI Pulse of the Profession Report cited only 55% of projects are completed on time, 62% are within budget, and 73% met goals. I will argue the 73% meeting goals is slightly misleading. Perhaps it should read, “met goals with higher costs and longer delivery times.”

As a result, many organizations have taken the stance of immediately “buffering” initial estimates with additional time and costs as their estimates have been consistently wrong.

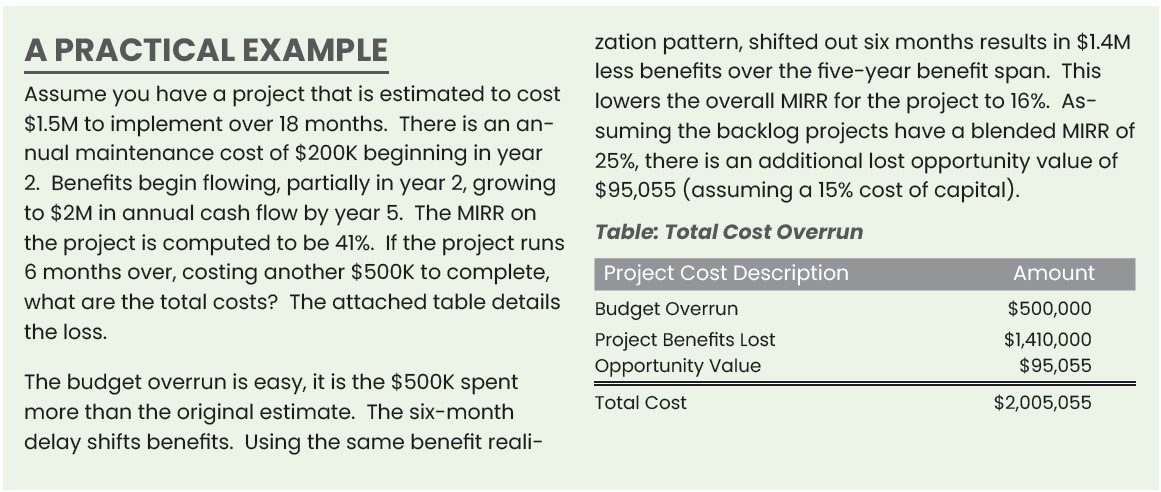

At issue is that many organizations don’t understand the true cost of project delays and overruns. When a project runs over budget, it delivers the same benefits at a higher cost, which results in a lower return on investment (ROI). This fact begs the question, would we have undertaken the project had we known the true costs?

During my time at Lowe’s, we used a modified internal rate of return (MIRR) to determine the value delivered for all capital projects. A driving reason for this metric was the company had substantial competitive pressure for capital dollars. New stores were expected to provide an 18% return (MIRR) over five years (note, this number changed over the years). The IT team, working with Finance, computed anticipated MIRR on all technology projects greater than a specified size. Our challenge was meeting or beating the new store construction hurdle rate. The reason?

If we couldn’t do that, the company was better served investing in new stores rather than technology.

Opportunity Costs of Technology

Most organizations have a plethora of technology projects ready to be started. Many of those have the potential to produce significant returns. When a project runs longer on time (and ultimately cost), we also lose the opportunity value of other projects that could not be started. And let’s not forget another convenient truth about troubled projects. Often, we cut scope (benefits) to “stop the bleeding” and finish the project.

What should organizations do?

- Measure the value of your projects. Whether it is return on investment (ROI), internal rate of return (IRR), or MIRR, you need a metric that measures project value. You will apply this metric to all active and approved backlog projects.

- Compute your project performance over time.

- How many total projects started?

- How many projects finished?

- How many finished on time, on budget, and on scope?

- What was the average spend versus budget?

- What was the average duration compared to the estimate?

While historical performance isn’t always a predictor of future performance, it does reveal organizational tendencies. You can also benchmark yourself against the PMI Pulse of the Profession Report to understand how you stack up against all other companies.

- Apply your performance benchmarks against your active and backlog projects to forecast what value you are leaving on the table. This forecast includes:

- Project cost over-runs (in most cases, this is labor)

- Deferred benefits

- Reduced scope (value not realized)

- Delayed value of other projects in the portfolio

- Finally, consider implementing a post-project audit that looks at value realization. Just as we measure ourselves against project estimates, we must understand if the projected benefits are being realized. In my previous organizations, this audit was performed by an independent group (usually from the Finance organization) on projects greater than a set threshold.

Early Warning Systems

Early Warning Systems

The key to mitigating their impact is to have an early warning system based on qualitative inputs to augment quantitative measures. The best way to develop this early warning is constant, structured communication with project team members and stakeholders. This feedback loop is crucial to understand the undercurrents impacting the project and arm project leaders with the insights to take corrective action.

Recalling the PMI statistic, imagine the impact if an organization is average and only completes 62% of efforts on budget. The 2020 Standish Group CHAOS Report underscores the importance of understanding the total costs of project delays and overruns. The 2020 CHAOS Report shows only 35% of technology projects fully met time, budget, and scope commitments. These sobering statistics add emphasis to the importance of improving project execution.

Of course, the next question should be, “how do I improve my project performance?” I believe organizations can implement three key actions to improve project performance.

- Align project methodology to the project type. The 2020 CHAOS Report cited improved performance of Agile methodologies, especially in larger projects.

- Use integrated project management tools. Modern project management platforms integrate planning, issue management, release management, testing, reporting, collaboration, and automation. In short, these aren’t your dad’s old Excel Gantt charts.

- Fill the gaps by addressing project intangibles.

Addressing Project Intangibles

The first two items are self-explanatory. What do I mean by the third item? Projects aren’t simply about the plans and numbers. I have witnessed numerous projects have statuses of “on-time” and “on-budget” for more than 80% of their duration end with significant cost/time overruns. The primary reasons projects are challenged or fail are items that won’t always appear in a project status report. These include:

Incomplete or misunderstood requirements

- Lack of user involvement

- Unrealistic expectations

- Lack of executive support

- Changing requirements

These issues happen to many projects. The later these issues appear, the more impact they have on budgets and timelines. I recently reviewed TrueProject by CAI. TrueProject is focused on the feedback loop that other project management tools and techniques miss. TrueProject automates and aggregates the project feedback process leveraging a broad library of project best practices. It ingests project quantitative data from Microsoft Project, JIRA, and others. It combines that data with qualitative project team feedback to display a comprehensive set of dashboards that show status and predict issues before they occur. It provides early warnings and risk indicators for all those moving parts under the surface that typically only reveal themselves when it is too late.

Think of it like Waze for projects.

We all know a simple 30-to-40 hour project can be managed on a piece of notebook paper or in Excel. However, when projects are more complex, and business outcomes ride on success, we need the right culture, leadership, techniques, and tools to drive project success.

Conclusion

We live in a time where digital technologies are pervasive. Technology projects to build or update digital technologies can provide immense value, but this comes with significant risk. Organizations must understand the dollars they are leaving on the table due to technology projects’ missteps. Armed with this knowledge, they can move from leaving money on the table to setting the table for success. Do this, and you will keep more of your Benjamins!

About the Author

Steve Stone is an accomplished executive with over 38 years of experience in the technology services and retail industries. Prior to founding NSU Technologies, Steve served as Chief Information Officer for two large US-based retailers, Lowe’s and L Brands, and was a senior executive at MicroStrategy.